Whistler's real estate market in 2014 could be the comeback story of global recession and the long road to recovery in the mountain resort town.

While there may not have been any headline-grabbing deals in the double-digit multi-million dollar range in the past year, Whistler's real estate, always subject to worldwide whims and trends, has been hotter this year than the past seven years, dating back to the financial meltdown and recession.

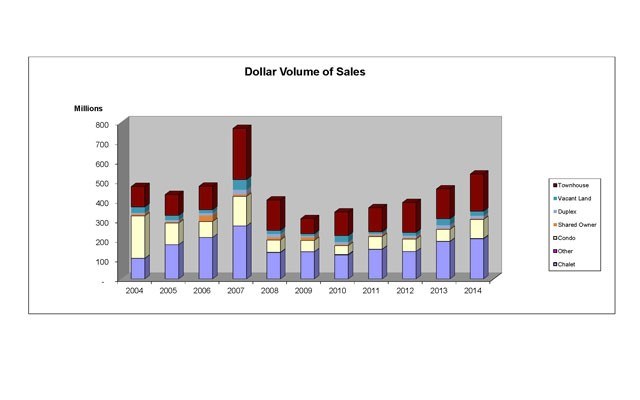

Total sales in the resort in 2014, according to the Whistler Listing System, reached $535 million. That's up 15 per cent over the previous year and it's the highest it's been in seven years, up from a low of $309 million five years ago. The same is true of the number of units sold — also at a seven-year high.

"For something to happen like what happened in 2008/2009 that really shakes people's confidence," said Pat Kelly, owner of Whistler Real Estate.

"I think it says a lot about Whistler that essentially the activity levels have returned to where they were beforehand, which really shows the confidence buyers have in the Whistler community and what Whistler offers as a recreational resort.

"They could have just drifted off and gone somewhere else and they didn't. They all came back. It really shows me that what we have has good maturity and has lots of support."

The 2014 numbers contrast to the low in 2009 of $309 million and the high of 2007 of close to $770 million.

"That was a very active year," said Kelly, of the year before the global financial meltdown reared its head in the mountains. "That was really the high point of the previous decade."

It's been a slow climb up since then.

The recovery is now seen in most sectors of the market though condo and townhouse sales continue to dominate market activity, making up almost 70 per cent of all sales.

Kelly's stats show average sale prices for condos rose 20 per cent to $390,165, while townhouses saw a three per cent jump on average to $697,073.

The average sales price of detached properties increased by almost 12 per cent to $1.6 million.

"Single family homes still constitute the largest single category in terms of total dollar value transacted," said Kelly.

Buyers, however, are predominately looking for places in the $1 million or less range.

More than 78 per cent of all reported sales in 2014 were reported below this level.

Whistler's top realtor Maggi Thornhill, who has sold the most real estate by far again this year, a position she has dominated for the past decade, said the market is showing great signs of recovery this past year.

Throughout the Christmas period, too, she saw renewed interest in the higher-end market.

"That's the first time in a long time that we're starting to see that happen," she said of the interest in the $4-6 million range and above. "That area of the market was really, really slow."

Thornhill said the impact of the strong U.S. dollar would be felt in Whistler.

"The exchange rate is going to have a huge impact," she said, not just from U.S. buyers but from around the world too — Hong Kong, Singapore.

"It's far-reaching. It's not just the U.S.," she added.

Chief economist with the British Columbia Real Estate Association Cameron Muir said the weak Canadian dollar is one factor.

The U.S. economy as a whole is recovering.

"We've seen very strong job growth south of the border. We're also seeing the U.S. markets fair much better as well," said Muir. "So that adds to the component of Whistler buyers who are coming from the United States."

Added to that is the provincial market, which has grown at about 15 per cent in total unit sales in the last year. Most regions in the province fared better in 2014 than in 2013.

"The rising tide floats all boats, if you will," said Muir.

"B.C. experienced a significant increase in housing demand last year."

Meanwhile, in the restricted market...

The Whistler Housing Authority transactions are not part of the Whistler market stats, but it too had a banner year.

Sixty re-sales took place in 2014 for a total sales value of roughly $19 million.

"That's the highest that we've had," said WHA general manager Marla Zucht.

She attributed that to the volume of inventory on the WHA's books and the never-ending interest in the price-restricted homes.

"The waitlist demand is still strong," said Zucht.

There are now 400 different households on the list; roughly 40 per cent of those are currently housed in price-restricted products, but are looking for something different.

The units, for the most part, are reaching their maximum price in the re-sales, save a few housing complexes that were subject to changes in their appreciation formula.