Whistler International Campus proposal alive and well

In regard to G.D. Maxwell's column of last week, to paraphrase Mark Twain, "The reports of our death have been greatly exaggerated." The Whistler International Campus (formerly Whistler U) is a proposal that is alive and well.

The Whistler International Campus (WIC) team was delighted to discover that our project meets or exceeds all six of the identified core criteria put forward by the RMOW's Task Force on Learning and Education report.

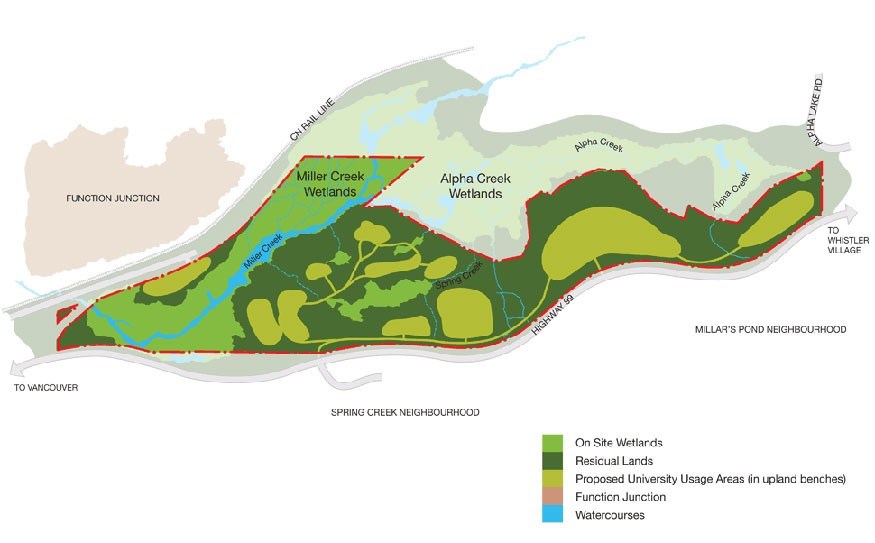

The WIC vision offers an opportunity to diversify and strengthen Whistler's economy with a naturally spectacular campus that will attract students and leaders from around the world to experience the beauty and uniqueness of Whistler. Because we have well-established, accredited education partners, we can offer programs that support Whistler's economic goals as soon as the project receives RMOW approval.

And it won't cost the taxpayer a dime.

The Whistler International Campus is a chance for my immigrant family, who has experienced good fortune here in Canada, to leave a legacy in a community we care about. We want to build something that gives back to this community, offering a vibrant education experience as a means to diversify Whistler's economy.

Like the Michael Audain museum project, sometimes opportunities present themselves that seem too good to be true. But they are and WIC is one of those opportunities.

We encourage the community to share in our vision by visiting www.whistlerinternationalcampus.com or attend our on-site open house on August 17 from noon to 3 p.m. at the Alpha lands. Let's make Whistler the place where the world comes to learn and play.

Roger Zen

Whistler International Campus

The value of private sector clean energy

Today, the clean energy sector is leading B.C.'s Jobs Plan and all British Columbians are beneficiaries.

Twelve projects which competitively won electricity-purchase contracts from BC Hydro in 2010, with capital expenditures totaling $2.6 billion, are being built as you read; projects such as Cape Scott Wind Farm on Vancouver Island, Kokish Hydro near Port McNeil, Forrest Kerr Hydro near Iskut, Kwoiek Creek hydro in the Fraser Canyon, Dasque Creek near Terrace, Skookum Hydro in Squamish and others. And 2,300 direct jobs, of which 690 are with Aboriginal people, have been created. An additional 6,000 indirect jobs through supply chains have been created in rural and urban places in the province.

Critics of clean energy state that electricity can be bought on the spot market for $35/MWh while the most recent purchase contracts with clean energy members is $94/MWh. The problem with this analysis is that no long-term economic development like B.C.'s Jobs Plan or LNG developments can be based upon the short term electricity spot market. Recall that in 2001, the same spot market exceeded $1,000/MWh and California faced rolling blackouts because it relied too heavily upon imported power.

A good analogy is choosing between a variable and fixed rate residential mortgage. If one locks into a long-term mortgage at five per cent and the rate drops to 2.5 per cent, one might have regrets. However if one chooses a variable rate mortgage at 2.5 per cent (i.e. spot market) with no option of renegotiating or locking-in later and the rates rise to 10 per cent then one is stuck with higher long-term costs. With a locked-in long-term mortgage at five per cent one has peace of mind of knowing what one's costs will be (analogous to long-term fixed price contract with clean energy supplier).

B.C.'s economic development has always been based upon the availability of long-term stable electricity at fair prices. BC Hydro's contracts with clean energy members are all long-term deals, up to 40 year terms at fixed prices except for a one-half of CPI escalator. The average price paid by BC Hydro in 2012 to private sector suppliers was $68/MWh. This is great value because no one can build new electricity generation for this price.

Today BC Hydro, a $10 billion company, has $15 billion in debts and $4 billion in accrued deferral accounts, which ratepayers will have to pay for. The long-term debt is almost all for capital replacement at old facilities such as John Hart and Ruskin and upgrades at Revelstoke and Mica dams. The deferral accounts include: imports that have not yet been paid for, pensions and post-employment benefits, First Nations negotiations and settlement costs, demand-side management programs (Powersmart), environmental compliance and Site C.

In 2011, BC Hydro sought a rate increase of 32.1 per cent which it tabled with the B.C. Utilities Commission. The government intervened and subsequently reduced the rate increase, however, the key point not to be lost is that only 2.6 per cent of the 32.1 per cent proposed increase was attributable to private sector clean energy producers.

Clean Energy BC member projects are built on time and on budget. Clean Energy member projects create jobs and pay taxes and enable First Nation economic development. We look forward to playing a key role in B.C.'s northern development plans including powering LNG with cost-effective clean energy.

Paul Kariya,

Executive director, Clean Energy BC Vancouver

Sprinkler madness

For those of you who don't know Whistler is a rainforest and we get abundant amounts of rain, yet over the last five years I have witnessed Whistler waste millions of litres of water, irrigating sidewalks, streets, and small patches of grass every night during the summer. Even during weeks where it rains pretty much every day Whistler continues to water the grass while most of us are sleeping.

I believe this is very careless and hypocritical for a town that prides itself to everyone on how green we are, how much we care about the environment, and how much we hate plastic bags. In past years, Pique Newsmagazine published an article that basically blamed us for using too much water per capita. No shit Sherlock! Divide millions of litres of water wasted by the RMOW each year by 10,000 residents, you do the math. We are being blamed for this malpractice.

Millions of litres of water wasting away before our eyes, so I took it as my duty to make sure this ridiculous problem gets taken care of. In the last two years I have managed to write emails back and forth with the mayor and the chief of Whistler landscaping so surely I was on the right path to getting this issue taken care of once and for all.

That was not the case. In the summer of 2012 after countless emails back and forth, after both parties acknowledged that I was right, nothing got done. Whistler continued to irrigate the grass rain or shine every night with a large portion of the sprinklers broken or defective, watering the pavement instead of the grass. I felt like my efforts were meaningless and a total waste of my time.

Summer of 2013 started up and the irrigation jokes were up in full force again. In an exchange of emails between me and the landscaping boss he told me that for the month of May they installed new turf so they will be watering more than normal. OK, fair enough. Then in early June he tells me they installed new sodding so they need to water more than normal. Hmmmm, OK... Now we are in July and Whistler still waters the grass every night.

To make matters more funny the RMOW wasted more tax money this year publishing an add in the Pique stating "only use 1 inch of water per week on your lawns to ensure stronger roots" and "water is a finite resource".

Am I on a hidden camera show or something cause I couldn't script a bigger joke if I tried!?

This year I decided to stop wasting my time trying to convince the two or three people in charge to change it. Instead I decided to film the events that I see on a daily basis and to inform the public in Whistler who may not be aware of this. I am sure once this issue is brought to light and more people get on my side that we will finally have this issue taken care of once and for all.

I created a page on Facebook called Whistler Sprinkler Madness where videos can be seen and we can share our opinions on this issue.

Bobert Caterina

Whistler

New NAP2 leader required

After several months of diligently working on the legal process to remove the asphalt plant and quarry industrial operations from our neighbourhood we have received the response from the Ministry of Forests, Lands and Natural Resources (FLNR): "The FLNR is not able to make a determination of whether or not something is considered a legal nuisance. ... the FLNR is unable to cancel a land tenure based on a petition claiming a nuisance."

The request was based on a breach of contract between the owner of Whistler Aggregates (quarry) and Alpine Paving (asphalt), Mr. Frank Silveri, and the FLNR. The contract is a Licence of Occupation for the petroleum and industrial complex located by the Cheakamus Crossing and Spring Creek neigbourhoods.

Article 4 – Covenant 4.1 (e) states:

"You (meaning Mr. Frank Silveri) must... not commit any willful or voluntary waste, spoil, or destruction on the Land (meaning quarry and asphalt plant area) or do anything on the Land that may be or become a nuisance or annoyance to an owner or occupier of land in the vicinity (meaning Cheakamus Crossing and Spring Creek neighbourhoods) of the Land."

The NAP2 team started a Public Nuisance and Annoyance Petition and collected 444 signatures in March 2013. We have obtained many legal documents and statistics from the municipality, most of them under the Freedom of Information Act from the past years as well. Over 1,000 times owners and occupiers of the 'land in the vicinity (meaning Cheakamus Crossing and Spring Creek)' of the quarry and asphalt plant complained and wrote how the industrial petroleum operations represent nuisance and annoyance to them.

Not only the Cheakamus Crossing and Spring Creek owners and occupiers are affected by the toxic pollution from the petroleum industrial complex, the visitors of the newly completed Bayly Park will be exposed to the harmful effect as well.

The NAP2 poured their hearts and souls (and money) into this approach, believing that the Cheakamus Crossing and Spring Creek Communities will be relieved from the wrong deed made by politicians in the past.

We are very sad and disappointed that the Public Nuisance and Annoyance Petition and other supporting documents and statistics did not accomplish the desired result. But we believe that our efforts were not wasted and seeds were sown for the future.

A new leader is needed to continue with this legal approach or a new approach to improve our beautiful neighbourhoods.

I am stepping down from the NAP2 Leader position. There must be someone who will continue with the No Asphalt Plant (and quarry) Actions. All documents are available, please, contact me at judybonn@telus.net.

Judy Bonn, BA (Health Services)

NAP2 Leader

Bags and other random ideas

I was excited to read Sara Jennings's letter in response to mine on the plastic bag issue.

I agree on the whole compost thing, buying stuff with minimal packaging. These are good steps, no matter what is going on.

But there was no indication of what she does when bringing her very little amount of garbage from her unlined bin to the compactor, once a month. Maybe she uses one of her many reusable store bags? But throwing them away isn't really sustainable either. And dumping loose garbage in the container isn't exactly containing it, or even legal for that matter.

I found her letter pretty long for never tackling the actual question that I raised. A lot of paper wasted for a politician-type answer.

On another note, I'd like to hear about the two different pairs of people who were not able to drive back out of Keyhole hot springs on July 1. The creek flowing over the road was way deeper than when they drove in and their small SUV couldn't possibly drive back through it. In fact, I wouldn't have tried with my full-sized truck. I offered them a ride back to town, but they declined it, asking me instead to notify their respective children of their whereabouts and situation.

I felt that the whole thing should be handled by the RCMP, so I popped by the Pemberton detachment on my way back to give them all of the information. It completely blew my mind how the RCMP tried to stay out of it, claiming it wasn't part of their duty, since the persons weren't missing (yet) or their lives (immediately) threatened. After talking on the phone (at the door) to be transferred to a voicemail and knocking on the window to get a uniformed officer to come out I finally convinced her to take care of a couple phone calls. I'm talking about four people out of cell reception who can't drive back, their next-of-kin unaware of anything. It was pretty clear to me that they were in trouble.

I'd like to know that Rick and Tina got out of there, hopefully with their RAV4, as did the other couple in a BMW.

Mathieu Samson

Whistler

Bearfoot, Oysters and Play!

A competition at a party with a purpose! Playground Builders is getting closer to completing 100 children's playgrounds in Afghanistan. At the Bearfoot Bistro World Oyster and Caesar competition funds were raised for new playgrounds for thousands of little people in Afghanistan.

Playful thanks to The Bearfoot Bistro folks of Melissa, Andre, Erin, Marc and all the happy staff.

Special thanks to Sawmill Bay Shellfish Company, Ketel One, Unsworth Vineyards, Albion Fisheries, Blue Mountain Vineyard and Cellars, Bowmore Islay Scotch, Codorniu, Evan, Gordon Food, Lea & Perrins, Motts, Sequra Viudas, Steller's Jay, Stoneboat Vineyards and our own Whistler Brewing Company.

Thank you Ace for the tunes and another thank you to Rick Cluff from the CBC for emceeing

Cheers to the winners! Eamon Clark of Rodney's Oyster House in Toronto and Scot Curry of Whistler's Alta Bistro.

This sold out Sunday Summer party of the year is happening again next year!

For more information about Playground Builders and how to donate please visit us at www.PlaygroundBuilders.org.

Keith Reynolds

Olive Branch "Playground Builders" Foundation

Whistler

Getting to The Point

Thanks to everyone who came out to The Point's inaugural Works-in-Progress Dinner Show on July 6, and to the great team of volunteers who made it all happen. Author Zsuzsi Gartner gave a fascinating presentation and Poor Dirty Sylvia ripped it up in true country-blues style! Thanks to Whistler Brewing Company and Purebread for generously sponsoring the event. We're looking forward to the next one on Saturday, July 27, with singer songwriter and winner of Pacifique en Chanson, Aude Ray, and the Scriptease Improv Team.

See you then!

Stephen Vogler

The Point Artist-Run Centre

Christmas is coming in July

The Rotary Club of Whistler Millennium would like to thank everyone who helped make our two Rotary Pancake Breakfasts at the Whistler Children's Festival this past weekend SO successful. Many thanks to Nesters Market for their continuing support of our Rotary Club!

Thank you SO much to all of our very generous sponsors and supporters: Whistler Arts Council, R.B. Brown Land Surveying, Nesters Market, Whistler Blackcomb, Great Glass Elevator, Bounce Acrobatic Academy, Whistler Kitchen Works, Starbucks Marketplace, The Circle Skate & Snowboard Shop, Früv Freedomwear, Old Spaghetti Factory, David's Tea, McDonald's, Quantum Vitamins, Dairy Queen, Crêpe Montagne, Whistler Core, Squamish Lil'wat Cultural Centre, Armchair Books, Norwex (Christine Wilding), Gill Hamilton, Gone Village Eatery and Senka Florist — we could not have done it without you.

Thanks to everyone who supported Rotary by enjoying our pancakes and buying our prize winning balloons, we were happy to be a part of your weekend. We also appreciate all the Rotarians and Friends of Rotary who came out to share in the work. A special thanks to our excellent helper Maya Christensen!

All proceeds from this event fund both community and international projects of the Rotary Club of Whistler Millennium. We are one of two Rotary Clubs in Whistler, and one of four clubs in the Sea to Sky Corridor. We meet at noon every Thursday at Pan Pacific Mountainside Hotel — all are welcome. Give us a 'like' on facebook.com/RotaryClubWhistler2000 to see what we're up to.

Please join us for our next fundraising event — Christmas in July on July 27th, from 5 to 8 p.m. at Nita Lake Lodge. Santa and his elves are taking a brief break from the workshop at the North Pole, and will be stopping by from 5 to 6 p.m. Get your shopping done early this year — silent auction items include hotel stays and unique artwork. Share a delicious turkey dinner at 6 p.m. with your family and adopted family, and don't worry about the dishes! Tickets for children and children-at-heart are now available at info@nitalakelodge.com.

Mary Ann Collishaw

President, Rotary Club of Whistler Millennium