The Resort Municipality of Whistler (RMOW) gave a comprehensive look into the makeup and demands of those on the Whistler Housing Authority's (WHA) restricted housing purchase waitlist this week as part of a presentation to mayor and council.

Speaking at a Committee of the Whole meeting on Tuesday, Oct. 8, the RMOW's economic development manager Toni Metcalf said the presentation was intended to "provide a deeper understanding of the purchase waitlist and to provide fact-based input into future policy and housing developments."

Waitlist makeup

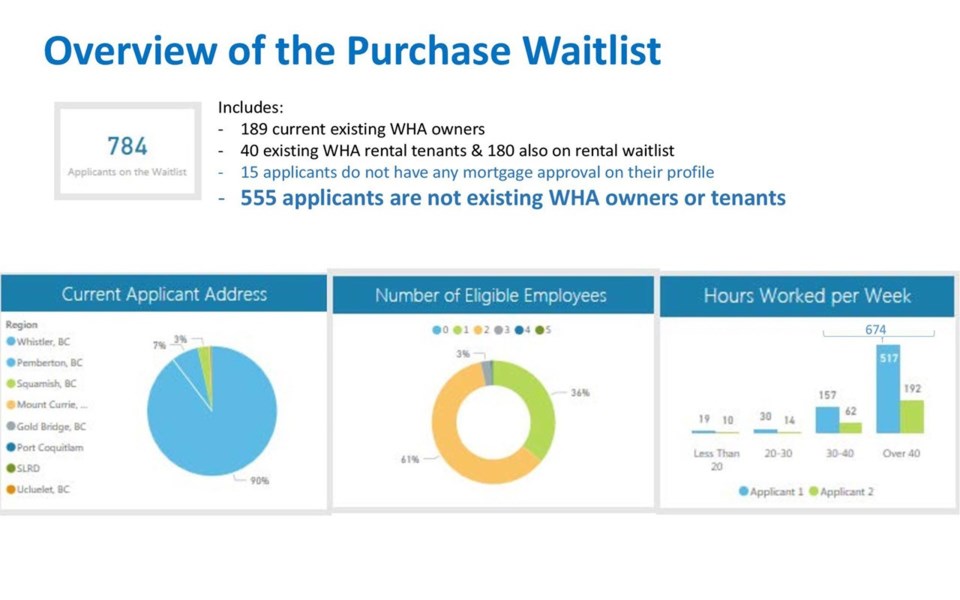

As of August, there were 784 people on the waitlist. Of those, 189 currently own WHA housing, 40 are current WHA rental tenants, 180 are also on the rental waitlist, and 555 are not existing WHA owners or tenants.

Roughly two of every three applicants, or 532, are either single or a couple without children or dependents, while 122 families have one child, 100 have two, and 15 have three.

Ninety per cent of those on the purchase waitlist currently live in Whistler, and close to 10 per cent reside in the Sea to Sky (there are a handful of notable exceptions, however, including those who self-reported living in Gold Bridge, Port Coquitlam and Ucluelet, which Metcalf said "needs to be looked at more closely").

More than a third of applicant households contain one eligible Whistler employee, while 62 per cent have two.

The average time spent on the waitlist is four years, although the majority of applicants are recent additions, having spent three years or less on the list. Of those, 88 per cent are non-WHA owners.

"That's not unsurprising when you think that eight to nine years ago, we had a significant amount of new inventory come onboard," Metcalf said. "We had Cheakamus Crossing, we had the Rainbow neighbourhood, which actually caused a glut of supply and there weren't actually sufficient buyers at that time."

Of those who have been on the waitlist between five and nine years, 55 per cent are existing WHA owners looking for an alternative property. That proportion typically goes up the longer an applicant has been on the waitlist, with more than 80 per cent of those on the list for 10 years or more already owning WHA property.

"They get on the waitlist, they get an opportunity to purchase a WHA home, whether it be an upgrade or they need a different size home over time, they are obviously keeping options open in the future," Metcalf said.

Families make up the bulk of applicants who have been on the waitlist for longer periods, with many looking to land a similar sized WHA home at a preferred price point or in a specific location, often closer to the village.

The most desired locations are fairly similar across the waitlist, with Fitzsimmons Walk, Spruce Grove, Nita Lake and Barnfield consistently ranking near the top of the list.

One trend that the RMOW noted was a desire among WHA owners in larger homes to downsize.

"Nearly half of existing owners in three bedrooms or larger have indicated that they would consider a smaller sized unit to downsize," Metcalf said.

That raised several questions among councillors about how to use existing WHA inventory to better serve the needs of residents, a challenge that has only been exacerbated by the fact that, on average, each applicant has requested three different unit types.

"Obviously when people are asking for a range of different properties, they are planning ahead, but how far are they planning and how does that impact the availability for those that have a need now?" Metcalf asked. "So, for example, a single person may be selecting a three-bedroom home, and if they're higher on the waitlist, they would have access to purchase that, where it may not be available for the next family on the waitlist to purchase."

Councillor Jen Ford, who serves as the chair on WHA's board, believes "there's a lot of work to be done on finding the most fair way of allowing those moves to happen."

Purchasing power

The RMOW also examined the purchasing power of applicants, comparing their submitted mortgage pre-approval limits with existing WHA inventory pricing.

The average total purchase price across the 769 applicants who had mortgage pre-approvals is $465,000, while the median purchase price is $430,000, which would require an annual household income of at least $94,000.

It should be noted, however, that nearly three in four applications were submitted prior to banking regulations introduced in early 2018 requiring a financial stress test to ensure borrowers would still be able to make their mortgage payments in the event that interest rates increase.

"Essentially what impact that had, was that that same gross income of $94,000, when you adjust for what the stress test requires, is that those who previously indicated a median of $430,000 may actually now only have access to purchase around $350,000," explained Metcalf.

"That's a significant drop of around 20 per cent in purchasing power."

Overall, the majority of mortgage pre-approvals were in the range of $250,000 to $600,000, and then drop off significantly above that amount, when prospective owners typically begin considering market housing. The maximum resale prices of WHA's inventory clustered in the $100,000 to $400,000 range.

The RMOW also drilled deeper into the purchasing power of applicants looking for certain unit types, and found that, specifically, there was a misalignment between pre-approved limits and resale values for those looking for studios and one-bedroom properties. The majority of applicants' approval amounts were in the $200,000 to $550,000 range, while most available studios and one-bedroom units fell in the $150,000 to $200,000 range.

"The initial view does indicate that there is some misalignment, if you like, of demand compared to the supply mix when we start looking at this, but certainly there is some overlap between those," Metcalf said.

Proposed next steps

Municipal staff compiled a list of several recommendations to improve the efficiency of WHA's ownership waitlist, including:

• Encouraging waitlist members to update eligibility information as part of the WHA's next annual confirmation review, particularly mortgage pre-approval limits and prioritizing their preferred unit types;

• Considering investment in software at WHA to streamline data collection and analysis;

• Further evaluating opportunities to improve the use of existing WHA inventory, including identifying demand for downsizing among existing owners, and reviewing turnover and demand for older, smaller, lower-priced properties, which typically see less demand compared to higher-priced units of similar size.