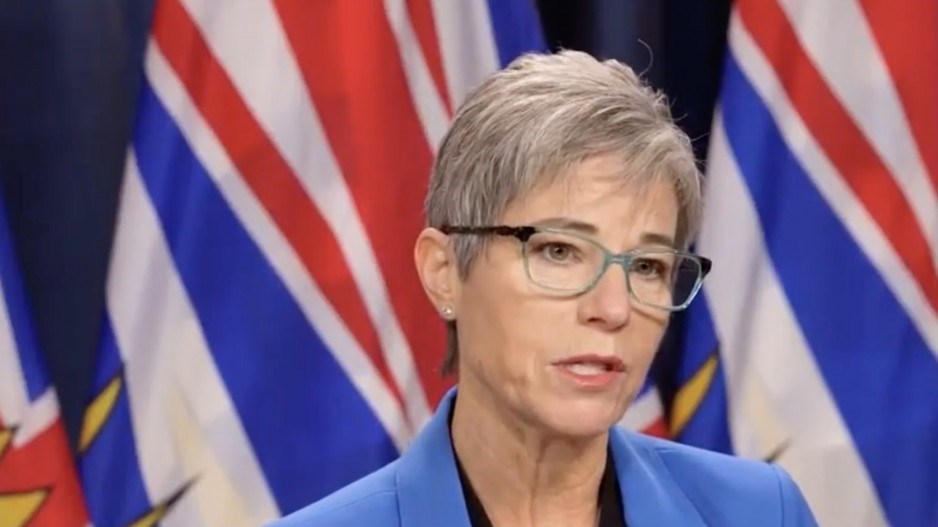

B.C.’s new finance minister, Selina Robinson, brought down a budget Tuesday that includes ongoing pandemic triage, significant new permanent spending on social programs and health care, no new taxes and a current deficit that is $5.5 billion less than the last forecast.

The budget for 2021-22 projects a $9.7 billion deficit and significant contingency funding built into it, which may not need to be spent, given the rate of B.C.’s economic recovery and employment levels.

"We have seen month after month of steady job gains, and British Columbia now has the best job recovery rate in Canada," Robinson said. "That does not mean all jobs across all sectors have reappeared, but it is reason for cautious optimism."

Budget 2021-22 includes $13 billion in additional operational spending over three years, of which $8.7 billion is in new, permanent program spending, and $4.6 billion in pandemic recovery and contingencies.

It also includes a $3.5 billion increase over three years to capital spending, which brings the total capital spend to $26.4 billion over three years. Capital spending will be focused largely on hospitals, education and public transportation.

But one of the top capital works projects on the wish-list of the business community in the Lower Mainland – replacement of the George Massey Tunnel – is not on the capital works priority list. It’s omission from the budget helped earn Robinson’s budget a B minus from the Greater Vancouver Board of Trade (GVBOT).

“While there was mention of a new George Massey Crossing, we continue to wait for news from government before the project can move forward,” said GVBOT president Bridgitte Anderson.

There are no new taxes or tax hikes in the budget, apart from ones that were previously scheduled to increase annually, like the carbon tax and an increase to the tobacco tax. The province will continue an exemption on the PST for equipment and machinery purchases.

Supports for business affected by the pandemic include $800 million in direct supports or foregone revenue, including the small and medium-sized business recovery grant program and tax incentives for new hires.

The budget allocates $120 million to support B.C.’s hard-hit tourism sector, including new funding of $20 million for community destination development grants.

The budget includes programs to employ laid-off hospitality industry workers in B.C.’s COVID-19 immunization efforts. It also provides $32 million for targeted skills training, micro-credentials and work experience placements.

The government is providing $500 million over three years for the InBC Strategic Investment Fund.

The budget includes $900 million in new funding to deal with the pandemic, for testing, contact tracing, equipment and vaccines.

To address housing affordability, the budget includes $2 billion in development financing to build 9,000 new homes for middle-income British Columbians over a period of three to five years.

Social spending and policies to address both the impact of the pandemic and affordability overall include:

a continued freeze on rent increases until 2022;

free public transportation for children 12 and under;

doubling child care spaces for those qualifying for $10 a day child care; and

seniors supplement doubled for 80,000 low-income seniors

The budget includes $4 billion in new investments in health care, including $2.6 billion in base budget funding over the fiscal plan period and $500 million over three years for mental health and addictions.

The spending includes training up to 3,000 health care aids.

The budget increases “green” initiative spending with an additional $506 million for CleanBC programs, including $94 million for rebates for zero emissions vehicle purchases, charging stations and conversion of commercial vehicles to low emission power sources. It includes an exemption of the PST on the purchase of e-bikes.

The deficit was last forecast at $13 billion for 2020-21, but is now set at $8 billion. It is forecast to top out at $9.7 billion for 2021-22, and then decline to $5.5 billion and $4.3 billion in subsequent years.

Declines in exports and wages in B.C. as a result of the pandemic last year were lower than forecast, and employment levels in 2021 are higher than expected. Robinson said employment levels in B.C. in 2021 have surpassed pre-pandemic employment levels.

The budget includes sizeable contingency funds, which the government calls prudence measures, to deal with uncertainties related the pandemic. These prudence measures total $5 billion in 2021-22, $4 billion in 2022-23 and $3.4 billion in 2023-24.

Some of the government’s plans for reopening certain sectors of the economy could be delayed, depending on the progress it makes at getting COVID-19 infection numbers down.

The government is budgeting for casinos to reopen in June, for example. Should pandemic restrictions need to be extended, and reopening of casinos delayed, additional supports may be needed.

Even stricter restrictions on travel in B.C. are coming, and possibly more “circuit breaker” restrictions, which means there may be more supports needed for affected business, which is why there are such large contingencies built in to the budget, Robinson said.

“It’s there for this very reason, so there are some resources there to help businesses as we continue to go through this third wave,” she said.

GVBOT expects not all of that contingency funding will be spent.

Given the size of these contingencies and a “very conservative economic forecast,” GVBOT expects B.C. “will outperform budgetary projections.”

[email protected]

@nbennett_biv

.jpg;w=120;h=80;mode=crop)