B.C.’s goal to reduce methane emissions from the oil and gas sector is two years ahead of schedule, a new analysis has found.

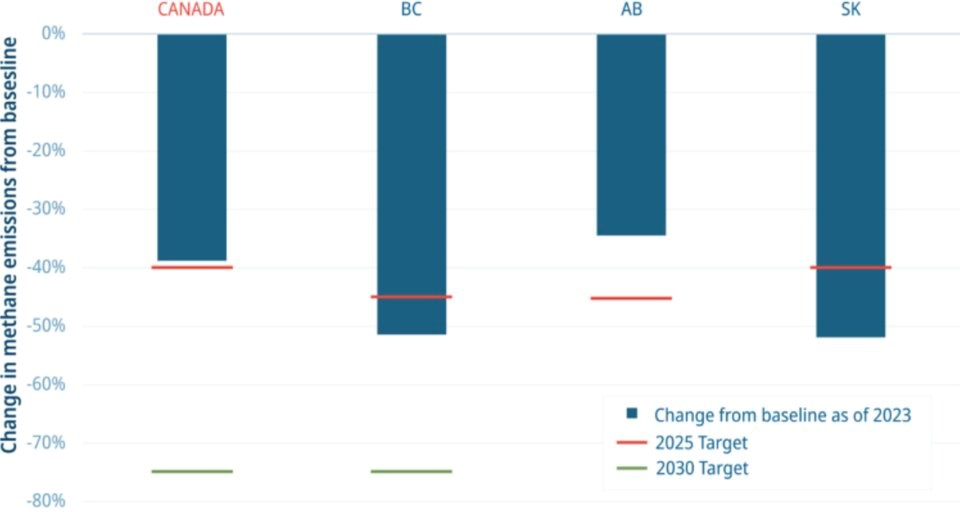

Released by the Pembina Institute Thursday, the report found the province was the only one in Canada to meet its 2025 oil and gas methane emissions reduction target.

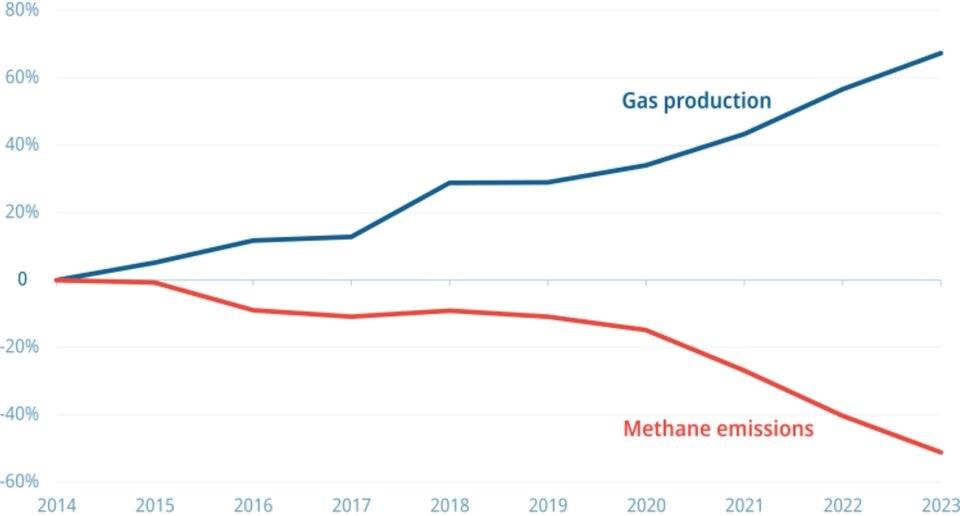

Between 2014 and 2023, natural gas production in B.C. grew 67 per cent. But over that same period, methane emissions associated with the industry fell 51 per cent — surpassing the 45 per cent reduction goal the province set for itself for 2025.

The progress is a positive sign for the industry at a time the carbon intensity of imports is becoming increasingly important to trading partners like the European Union, United Kingdom, South Korea and Japan, said Amanda Bryant, a senior analyst with the Pembina Institute who carried out the analysis.

“What it means is that B.C. has put itself in a really good position in the global competitive economy as that economy starts to prioritize low carbon products,” said Bryant.

“B.C. has shown that you can succeed in regulating methane gas emissions in a way that benefits instead of harms industry.”

When methane — the main ingredient in natural gas — leaks into the air, it acts as a greenhouse gas 80 times more powerful than carbon dioxide over the first 20 years in the atmosphere.

Bryant said B.C. can make improvements to avoid that from happening in number of areas over the coming years.

That includes converting gas-driven pneumatic devices into zero-emission alternatives and ensuring underperforming or unlit flares at gas extraction and processing sites are properly burning off methane.

One large and continuing source of methane emissions comes from compressor engines, which drive methane through natural gas systems. Bryant said technology and policies to reduce those emissions are still in their infancy.

Looking ahead, B.C. has set methane targets for 2030 and 2035. Federal rules for 2030 were on the brink of being finalized before Parliament was prorogued earlier this year to allow for a federal Liberal Party leadership race.

If the provincial regulations are strong enough, such as in B.C., the federal government can stand down their regulations in five-year periods. But that might not be the case for Alberta and Saskatchewan where progress to reduce methane emissions has been much slower.

According to the Pembina analysis, it appears Saskatchewan has also already achieved its expected 2025 methane reduction. But Byant said those reductions coincided with a decline in oil and gas production in the province, and according to previous reports, methane intensity remains extremely high in the Prairie province.

Meanwhile in Alberta, Premier Danielle Smith has vowed to take Ottawa to court over the proposed federal restrictions despite early industry enthusiasm to reduce methane leakage, according to Thomas Green, a senior climate and policy advisor with the David Suzuki Foundation.

Green, who has worked on methane emission reductions at the federal and provincial levels for years, said the data coming out of B.C. is good news.

“This is one of those low hanging fruit. There’s no excuse to release all this methane. We have the technology,” Green said. “I’m glad we’re on this step. But we need to be aiming for near zero. It’s such a potent greenhouse gas.”

Green agreed that the reductions shown in the Pembina report help show B.C.’s trading partners that its gas emissions intensity is going down. But he also pointed to recent studies that have challenged the idea B.C. gas is well positioned in the global market.

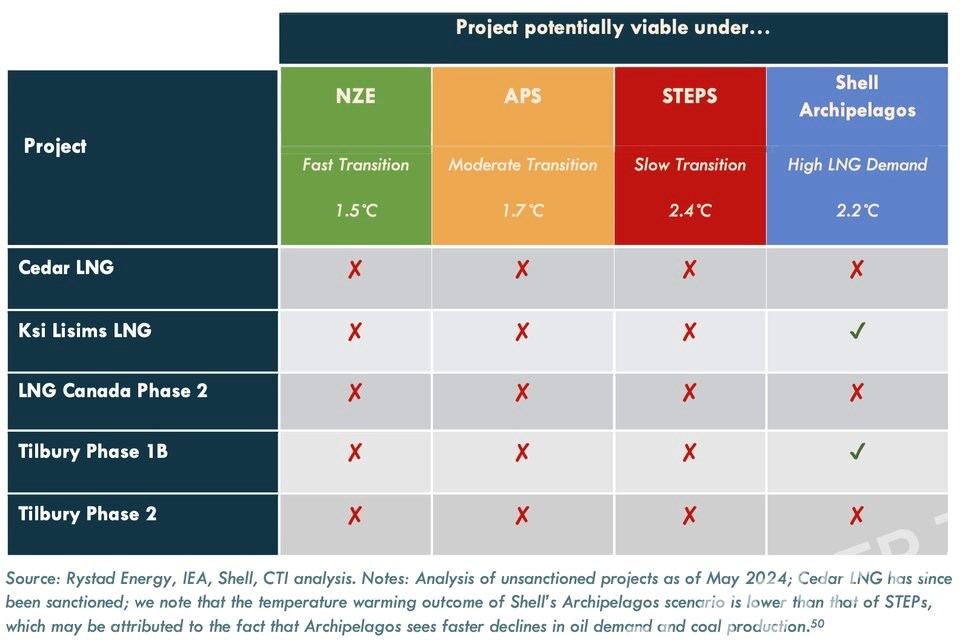

An October 2024 report produced by the U.K. firm Carbon Tracker, on commission from the David Suzuki Foundation and the Pembina Institute, found all of B.C.’s proposed LNG projects are at risk of generating lower than expected returns as they arrive as a “late entrant” in markets already dominated by lower-cost, more established producers.

The report found B.C.’s Cedar LNG, LNG Canada Phase 2, and Tilbury Phase 2 projects would not be viable, even under a high-demand scenario.

Unsanctioned projects — which would exclude facilities such as LNG Phase 1 and Woodfibre — were forecast to produce gas 26 per cent more expensive than the global average. B.C. gas was forecast to cost up to 80 per cent more when compared to gas from bulk producers in the U.S., Mozambique and Qatar.

“You can have low emissions intensity gas, but you might not be able to sell it,” said Green.