A pilot project allowing dozens of people in Whistler’s Tapley’s Farm neighbourhood to participate in the Provincial Deferred Taxation Program (PDTP) will not occur.

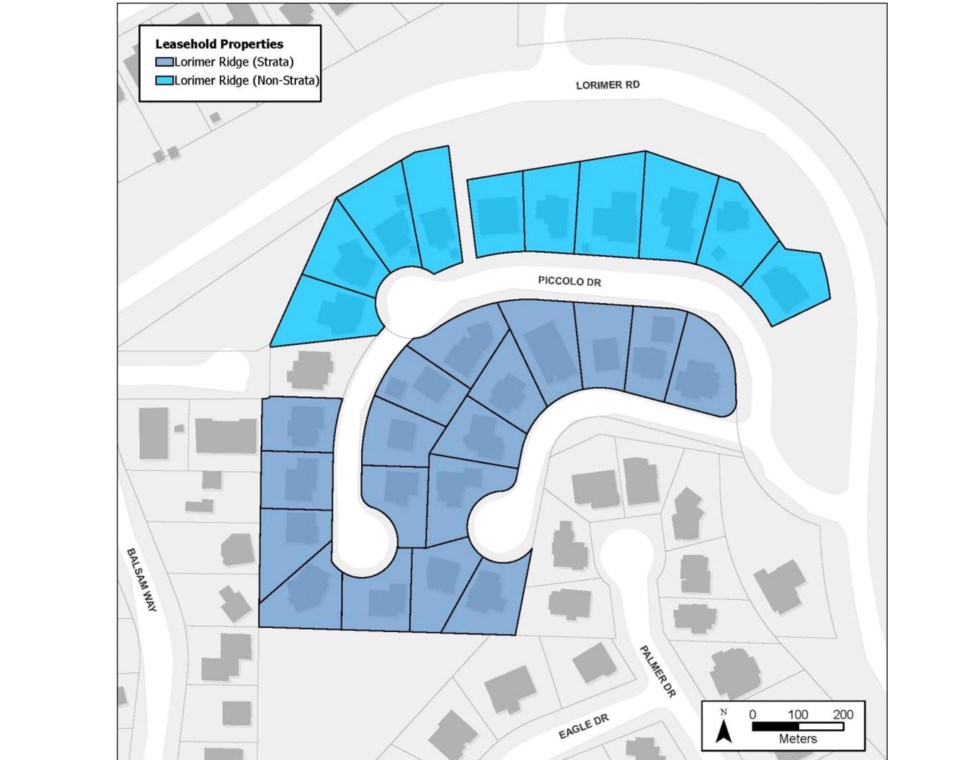

On March 7, the Resort Municipality of Whistler’s (RMOW) mayor and council opted not to implement a title-change pilot for 28 leasehold properties in the Lorimer Ridge Strata, located adjacent to Myrtle Philip Community School on Whistler Housing Authority-owned land, that would change the properties’ titles from leasehold to fee simple ownership and allow residents to access provincial taxation relief.

According to Lorimer Ridge strata president Robert Risso, the pilot’s goal is to give aging strata residents access to the PDTP to provide some tax relief for residents as property values and associated taxes have risen significantly.

“As our residents have aged, some of them came up against [the problem] that they couldn’t defer their property taxes,” Risso said. “We had a few residents who reached that age and wanted to do that and found that they couldn’t, because they were leasehold. So we started this initiative to say, well, could we change that?”

The PDTP is a provincial low-interest loan program that allows individuals to defer paying property taxes on their principal residences. The program is open to people aged 55 or older, with children under 18, a surviving spouse, or eligible persons with disabilities.

Currently, the PDTP does not apply to municipally-owned leased properties. Residents must pay annual property taxes on properties now worth millions, amounting to thousands in additional costs, which can be cumbersome for house-rich but cash-poor occupants.

Until 1993, lease stipulations were the only way to implement occupancy restrictions under the Municipal Act (now the Local Government Act). All pre-1993 Whistler Housing Authority (WHA) housing stock are leasehold properties and cannot be part of the deferment program, which will become a more significant issue as Whistler’s WHA-housed senior population grows. In the 2021 census, people aged 65 or older comprised nine per cent of the community, up from seven per cent in 2016.

Risso believes that changing the strata properties to fee simple, with continued occupancy-restricted housing covenants, will help residents acquire financing, as some banks will not lend to leasehold properties. The pilot could also provide a guide for other municipally-owned leasehold properties to follow.

“In the big picture, I don’t know how many other properties in Whistler could be impacted by this [freehold change], but as we show the road to it, as a pilot project, which we proposed, how many more could be?” Risso said. “We know there are hundreds of leasehold properties [in Whistler], but whether they would all comply or not, we don’t know.”

RMOW staff opposed the pilot primarily to safeguard the land for future employee-housing developments. If the leases are not renewed or expire, the WHA or RMOW can develop new housing in the prime location without purchasing the properties at market rate.

“Lands owned by the WHA are valuable municipal assets. If the leasehold agreements are terminated in the distant future, the cost to the RMOW and WHA for acquiring the properties would be the fair market value of the buildings and other improvements,” RMOW planner Joanna Rees said in a presentation to council. “These lands also provide potential opportunities to address future community needs in prime locations.”

A report to council notes the current leases last 60 years, and extensions are available for another two terms, finishing in 2173. From staff’s perspective, the urgency to plan for the area’s long-term future is low.

While the pilot will not move forward, the RMOW does share some sympathy with the residents on the tax deferment issue. Mayor and council approved a resolution to work with the WHA to advocate for the provincial government to amend the deferment program to include municipally-owned leasehold properties.

“This report has exposed something that is a problem for us, which is these homes not being able to access tax deferral but also other employee housing in our community,” Mayor Jack Crompton said. “I think the part of this resolution that says we’re going to get to work advocating to see the province allow for deferment to take place on properties like these, and then other employee housing projects, is important, and one that’s easier to get to work on.”