Rising costs for housing, child care and groceries are among the key factors resulting in a higher “living wage” in many B.C. communities, according to a new report from two research and policy groups.

For a family of four to live "modestly" in Metro Vancouver, it now takes both parents working full-time and earning $24.08 per hour — a 17.3 per cent jump from last year’s wage of $20.52.

Living Wage for Families and Canadian Centre for Policy Alternatives-BC, say all B.C. communities are facing similar hikes to their living wage estimates, largely due to inflation of food prices and persistent rising housing costs.

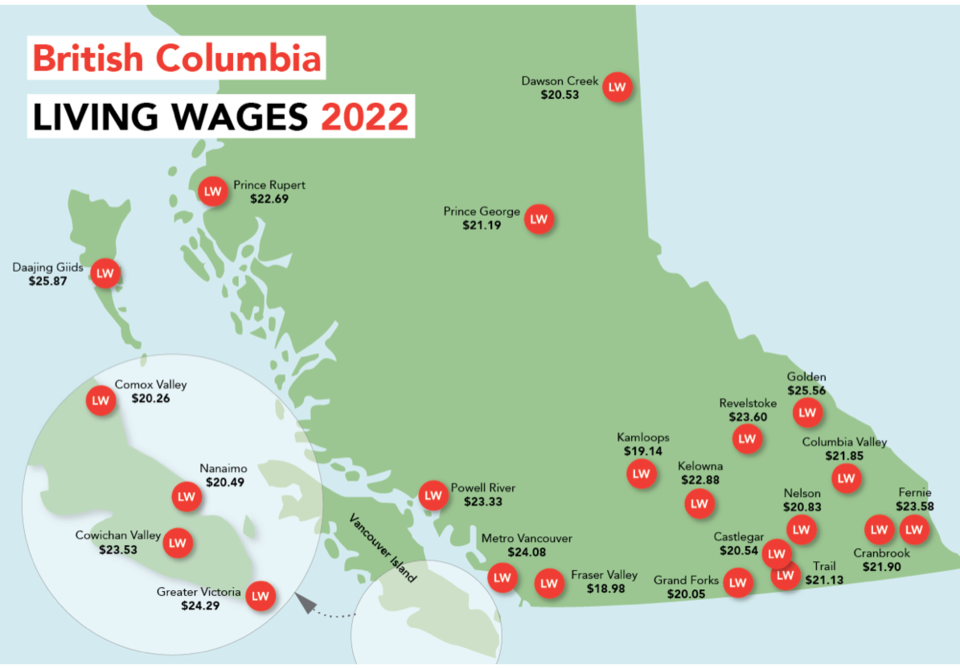

Among 22 communities assessed, Daajing Giids comes in with the highest living wage at $25.87 while Victoria is the most expensive city at $24.29.

The groups consider a living wage the amount needed for such a family of four to pay for necessities to live a "modest" life while supporting the healthy development of the children.

For Metro Vancouver, this means, on average, spending $2,484 on a three-bedroom shelter, $1,114 on food, $892 on child care, $971 on “household and social participation” and $546 on transportation. Other costs under $200 include phone and internet, monthly clothing and education costs. The living wage ($43,826 annually) factors in government supports, including child benefit and GST credits from provincial and federal governments.

A living wage does not contemplate paying for loans, retirement savings, home ownership costs, emergency savings, costs to support a disability nor vacations.

Food costs have soared 16.9 per cent, or $161 monthly.

But the biggest factor of all is housing, the groups assert.

Affordability crunch harder on families who've had to move

The new living wage figure includes a reformed method of measuring housing costs for the purpose of determining a living wage. Previously, housing costs were determined by the Canada Mortgage and Housing Corporation’s (CMHC) median rents prices in purpose-built rental units. Hence this captured long-term tenancies that cost less due to rent-control measures.

Now, the groups have calculated a “moving penalty” that increased the living wage family’s rent costs from $1,952 (the CMHC median rent figure) to $2,186 monthly.

The groups note the affordability crunch is more dire for families who have had to move and thus re-enter the rental market. This is because they may lose a long-term fixed-rate lease and face new and much higher entry price points.

The study also found, based on census data, that families with children move more frequently than others.

“With general inflation shooting up to a 40-year high this year and with the cost of food rising even faster and rent increasing everywhere, especially for families that need to move and are no longer protected by rent control, it’s not surprising to see such big increases this year,” said Anastasia French, provincial manager for Living Wage for Families.

The groups are still not counting the rise in rental rates in the secondary rental market (privately owned homes).

Child-care costs are also driving up wage needs.

The living wage factors in $892 per month based on a four-year-old in full-time licensed group care and a seven-year-old in before- and after-school care. This includes a roughly $600 reduction from the taxpayer-backed BC Affordable Child Care Benefit.

Furthermore, families are being pinched by many more minor increases, notes the report titled Working for a Living Wage, authored by French, Iglika Ivanova and Shannon Daub. For example, the price of a basic family health insurance plan increased by $37 per month, or 19.7 per cent this year, due to a sharp increase in the price of dental coverage (from $99 to $134 per month). And phone and internet costs are up about $9 per month since last year.

The report calculates monthly household costs ($971), such as supplies, laundry, bank fees, some reading materials, minimal recreation and entertainment, cultural events and birthday presents are up a combined 14.4 per cent from last year.

The report notes the Metro Vancouver living wage family receives substantial government support through the Canada Child Benefit, the BC Affordable Child Care Benefit and the BC Child Opportunity Benefit, a total of $16,942 in 2022. Without these benefits, the Metro Vancouver living wage would have been significantly higher.

The report also comes with a warning: government assistance for low- and modest-wage earners, such as child-care subsidies and the elimination of health-care premiums (MSP), is believed to have been “wiped out” by these rising shelter and food costs, said lead author Ivanova, senior economist at CCPA-BC.

“Good public policy can make life more affordable for families and when government transfers don’t keep up with the rising cost of living, the families hardest hit are headed by already marginalized earners, including single mothers, Indigenous people and recent immigrants,” said Ivanova.

The CCPA-BC is considered a progressive think-tank that promotes greater redistribution of wealth, via taxes and government programs, from wealthier individuals and corporations to targeted low- and modest income-earning people.

The report also stresses the need for more employers to commit to a living wage index. As it stands, the minimum wage in B.C. is $15.65, which means there's a $8.50 gap to Metro Vancouver's living wage.

The report claims there are nearly 400 certified “living wage employers” across B.C., including many small businesses, non-profit organizations, unions and cooperatives, plus 14 local governments as of October 2022, including Burnaby, Langley, New Westminster, North Vancouver, Pitt Meadows, Port Coquitlam, Quesnel, Vancouver and Victoria.

These are the 22 B.C. communities with a living wage assessment:

Castlegar $20.54

Columbia Valley $21.85

Comox Valley $20.26

Cowichan Valley $23.53

Cranbrook $21.90

Dawson Creek $20.53

Fernie $23.58

Fraser Valley $18.98

Golden $25.56

Grand Forks $20.05

Haida Gwaii $25.87

Kamloops $19.14

Kelowna $22.88

Metro Vancouver $24.08

Nanaimo $20.49

Nelson $20.83

Powell River $23.33

Prince George $21.19

Prince Rupert $22.69

Revelstoke $23.60

Trail $21.13

Greater Victoria $24.29

Editor's note: An earlier version of this story incorrectly stated Victoria had the highest living wage. Daajing Giids (on Haida Gwaii) is the highest at $25.87.