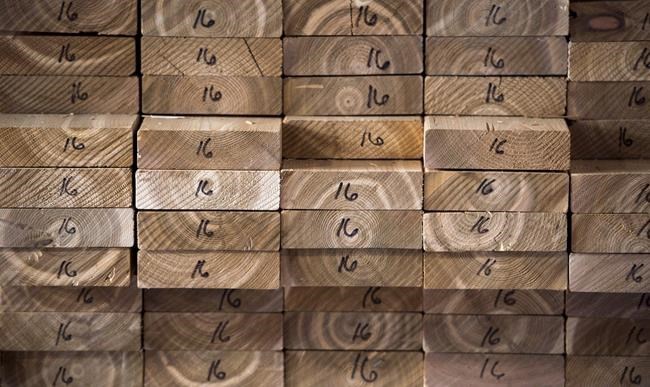

CALGARY — New record high prices for lumber and wood panel products thanks to continuing robust demand from renovation and new home markets are driving stock prices higher for Canadian producers.

Five of the largest producers — West Fraser Timber Co. Ltd., Interfor Corp., Canfor Corp., CanWel Building Materials Group Ltd. and Norbord Inc. — all set new 52-week high share prices Wednesday in trading on the Toronto Stock Exchange.

The strong prices are expected to continue for some time, said RBC Capital Markets analyst Paul Quinn in a report.

"While we recognize that current prices are partially attributable to tight inventory levels through the supply chain, we expect that record repair and remodel demand, rebounding new residential construction activity, and COVID-19 related supply challenges will be enough to keep wood product prices at still historically strong prices through the next few months," he said.

"We still see some upside to our 2021 estimates if rising new residential construction demand is enough to offset the seasonal slowdown in repair and remodel activity."

RBC is increasing target prices for nine forestry companies it covers, with the biggest jumps of $8 per share to $85 for West Fraser and $7 per share to $57 per share for Norbord.

The two companies were trading at $72.85 and $46.95, respectively, at midday Wednesday.

Analysts quoting industry watcher Random Lengths report that western SPF (spruce-pine-fir) lumber prices rose 5.9 per cent or US$45 between last Friday and Tuesday to a new record of US$805 per thousand board feet.

That price is 23 per cent higher than the previous nominal record price of US$655 in early June 2018, CIBC noted in a report, adding it exceeds the all-time high in November 1996 of US$480 or US$775 in today's dollars, after adjusting for inflation.

Meanwhile, oriented strand board — a type of wood panel used in construction — rose by US$15 to a range between US$605 and US$620 per thousand square feet over the same four days.

The price report was published the same day that U.S. housing starts in July were reported at about 1.5 million, well above expectations and a positive sign for wood product demand.

A week earlier, Canada Mortgage and Housing Corp. reported housing starts in Canada in July rose nearly 16 per cent compared with June, also easily beating economists' expectations.

Home builders in the Calgary area say the increased wood product prices have bumped up the cost of building a typical home by $8,000 to $10,000 so far this year.

On Wednesday, Lowe's Companies, Inc., reported U.S. comparable home improvement store sales increased 35 per cent in the second quarter versus the same period of 2019.

Despite the strong prices, Canadian producers have been signalling caution about ramping up production.

Earlier this month, Norbord announced a limited restart of one of two production lines at an oriented strand board mill at Cordele, Ga., that had been indefinitely curtailed last November due to poor anticipated OSB demand.

But it said it wasn't planning any other moves.

"Though these recent developments give us reason for optimism, it is unclear whether the worst of the pandemic is behind us, therefore we will maintain our approach of planning for the worst but being prepared for better," said CEO Peter Wijnbergen in a news release.

Similarly, CanWel chairman Amar Doman said in a recent second-quarter results press release he is "pleased and encouraged" by the surge in demand for wood products but remains cautious about making new investments.

West Fraser Timber, meanwhile, pointed out that there is too much uncertainty to do more than continue to operate as close to full capacity as possible.

"It is not possible to predict at this time what impact, if any, the ongoing COVID-19 pandemic or the resumption of industry lumber production in British Columbia may have on earnings," it stated in its second-quarter news release.

This report by The Canadian Press was first published Aug. 19, 2020.

Companies in this story: (TSX:CFP, TSX:WFT, TSX:IFP, TSX:CWX, TSX:OSB)

Dan Healing, The Canadian Press