TORONTO — Canada's technology sector is worried small businesses will take longer than foreign giants to rebound from a global shortage of semiconductor chips — and say consumers might pay the price.

With most of the world's chips made outside of Canada and brands as big as Nintendo, Samsung and Apple vying for them, they fear larger players will get access to supply first and their consumers will end up with higher prices and long wait times.

"(Manufacturers) want to satisfy their biggest customers, but for the little guy like me, I'm getting hit. I'll lose half my revenues this year," said Filip Ivanovski, the founder of Gametime Technologies Inc., a Quebec company that makes portable scoreboards and has been out of chips for months.

"I've been completely sold out since probably early March and now I'm in an at least four-month delay before I even get my inventory."

The chip shortage disrupting Gametime and others materialized last year as people purchased new gadgets while spending more time at home during the COVID-19 pandemic.

Chip factories were simultaneously facing temporary closures, mostly to quell the spread of the disease, but one Japan plant was also engulfed by a fire and another in Texas was shut down by a cold snap.

When they reopened, there was a backlog exacerbated by the launch of the coveted PlayStation 5 and Xbox Series X, and a trade war between the U.S. and China, where many chips are made.

Now, Apple is warning the shortage could cut US$4 billion from its sales, General Motors has already temporarily laid off 1,500 workers at its Ingersoll, Ont. plant because of the lack of chips to implant in vehicles and Canadian toymaker Spin Master Corp. says it is considering price increases to deal with the situation.

IBM chairman and chief executive Arvind Krishna called the situation "very worrisome" because capacity can take months to scale up and the shortage impacts everything from cars and consumer electronics to tablets and computers for students.

"People are being asked to make what I'll call a really unfortunate dilemma: which will get prioritized?" he said during a media roundtable earlier this month.

"That's really hard to do."

Joe Deu-Ngoc, the co-founder of Toxon Technologies Inc. and Tincubate in Waterloo, Ont., fears small businesses will be low on the priority list.

Toxon is the maker of the BOWdometer archery practice device and Tincubate is a consultancy and tech-sector incubator.

During past shortages, Deu-Ngoc noticed large companies overcorrect by ordering huge quantities of chips to keep as inventory.

"It further pushes out that shortage and it actually creates artificial shortages to greatly affect the smaller guys, such as ourselves and many of our clients," he said.

The longer companies wait for chips, the more likely they are to contemplate laying off workers or increasing prices because there is no product to assemble, inventory to market and sales to offset costs, he said.

Climbing out of the shortage is tough because small businesses don't have the reputation or cash, which would help them get pushed up the priority list, he added.

Toxon and Tincubate, for example, have been in business long enough that suppliers are advising them wait times for chips could amount to 26 weeks, but they've heard of younger companies without relationships being told 52 weeks is more likely.

"If you're already in, you'll be able to starve out the guys that are trying to get in," Deu-Ngoc said.

"You're going to see a shift between who can do the innovation and, and who will crumble under a lot of these economic pressures."

Melissa Chee, the president of VentureLab tech hub in Ontario's York Region, worries about the ramifications of the shortage so much that she and a series of manufacturers, business leaders and investors co-founded Canada’s Semiconductor Council earlier this month.

The group wants to build a semiconductor strategy for the country and bolster its supply chain resilience, giving Canada a piece of the $7-trillion market for such chips and small businesses some peace of mind.

Building that strategy will take time. Chee estimates semiconductors can take between five and seven years to be commercialized and end up in products.

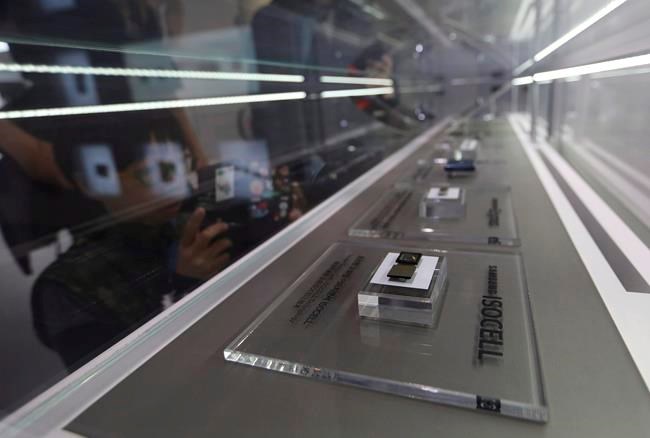

IBM, for example, unveiled a two-nanometre chip this month that promises to use 75 per cent less energy than existing seven-nanometer chips and quadruple battery life, but it won't be in production until 2024.

"The semiconductor industry is a huge industry that's always been known to be cyclical and then what COVID really did is amplify that," said Chee.

"As COVID went on, demand from consumers and other stakeholders didn't really match the orders that were placed and there was a lot of unpredictability."

A national strategy, she said, will give Canada its first comprehensive view of what needs the country has and how an ecosystem can be built to service them.

Acting soon will be very important to keeping small businesses from being hurt further or losing their chances of becoming global tech titans, Chee believes.

"This is really a critical juncture, as we look forward to economic recovery," she said.

"This is our opportunity to own the podium."

This report by The Canadian Press was first published May 25, 2021.

Companies in this story: (TSX:TOY)

Tara Deschamps, The Canadian Press