Can you imagine what Whistler would be like if visionaries had not put the Whistler Housing Authority (WHA) in place in 1997?

Can you imagine how much more challenging things would be here if the Resort Municipality of Whistler (RMOW), our council of the day and a few crucial stakeholders had built a temporary 2010 Olympic and Paralympic Athletes' Village instead of investing in the new neighbourhood of Cheakamus Crossing?

It is true that by every metric we use, housing is consistently at the top of the list of concerns, and it should be there.

But there also has to be an understanding that there is only so much local government can do to keep roofs over people's heads.

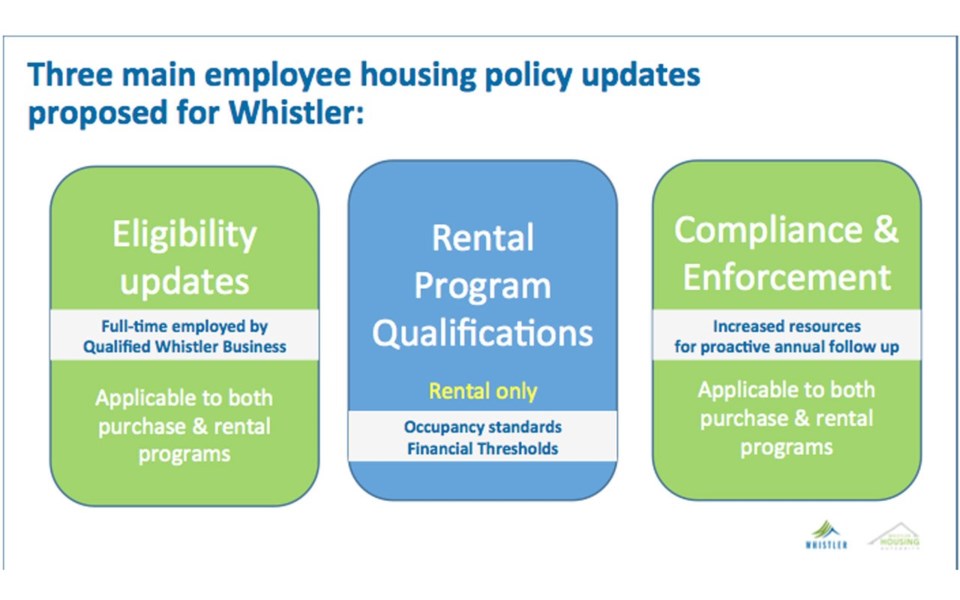

This week saw our council and mayor adopt changes to the employee housing policy, which will help to keep a strong focus on the priority of the program, which is housing workers affordably.

WHA housing is not there for those aging out, cashing in and hoping to stay in a nice building for low rent in their golden years.

This is a rather harsh reality as many of those heading into retirement want to stay here but also need to sell their homes to do so and secretly hoped that they could find secure seniors' rental housing appropriate to their needs. One of the most challenging issues in this community is the merry-go-round of rental. Landlords often ask tenants to leave and from a senior's point of view (or anyone really), this is distressing and stressful.

But to be eligible for employee housing, the applicant must have household assets of less than $300,000. Gone is the ban on owning another property as a criteria; instead, all assets are looked at globally, so cash, bonds, stocks, mutual funds and term deposits, Tax Free Savings Accounts (TFSA), real estate equity (net of debt), business equity in a private incorporated company, including GICs, cash, stocks, bonds or real estate equity.

And for seniors, the eligibility criteria sees you having to live and work here 10 years out of the previous 12, up from five of the last six years.

Again—it's an effort to reach those in need who are truly long-term community residents.

For years, we have heard the many stories of people who abuse the WHA housing policies. And it is infuriating. But it must also be remembered that while there is a global vision statement and policy, the reality is that different buildings, or even neighbourhoods, which came online at different times, have different rules.

There has even been an issue with suites, mandated to go into market homes with a view to being part of employee rental pool, sitting empty because while the suite had to be put in, there was no provision that said it had to be rented out. In other cases, the rate at which the suite would be rented is so low as to make it not worth the landlords' investment in view of the risk of damage from tenants.

And enforcement and follow-up on abiding by the rules has been really challenging for the WHA.

How does it access information to prove that two people are living in a place while one of them own and rents out a market home in Whistler?

This new policy, we hope, comes with some teeth. The WHA and the RMOW are getting ready to hire a employee housing compliance officer who will perform audit processes, investigate and follow up on the use of all employee housing, including annual statutory declarations. There will be an independent verification service, that will perform the review of applicant's financial documentation on behalf of the WHA.

This will include an annual audit for the rental program, with the onus on the applicant to report their financial and work situation using proper documentation. Failure to do this could mean losing their WHA home.

There is much to applaud in the changes, with the focus clearly on helping those who are at the lower end of the earning and housing spectrum.

But it does nothing for the middle portion of residents who are squeezed from both sides. They earn a bit too much to qualify for WHA subsidy, but to buy into the market means spending considerably more than 30 per cent of household gross income on housing (Canadian Mortgage and Housing Corporation's affordability metric).

Catch 22.

What we all know from the years of dealing with this issue is that there are no easy answers, there is no one-size-fits-all solution. But we must keep moving forward while remembering that, incredibly, 81 per cent of our employees work and play where they live.