I’ll never forget the first time I began taking my finances seriously. I was in a meeting with a financial services adviser at my local bank, requesting an increase to my personal credit limit. I needed (read: wanted) to buy some new camera equipment, and my current credit card didn’t have the capacity. I was still in my 20s, working seasonal jobs as a ski instructor and summer ATV guide, and had aspirations of becoming a professional photojournalist. The only assets I owned were a beater of an SUV, a couple of bikes, a few pairs of skis and soon, a shiny new camera.

“Have you put any thought into planning for your financial future?” asked the adviser, trying to not sound like a parent. “Are you saving any money for your retirement?”

The notion of squirrelling money away at this point in my life was completely foreign. Whistler was about living the dream lifestyle in the moment, not working for some far-off retirement date when my knees would be too sore to ski anymore. I confessed to the adviser that no, I hadn’t thought about my financial security—future or otherwise.

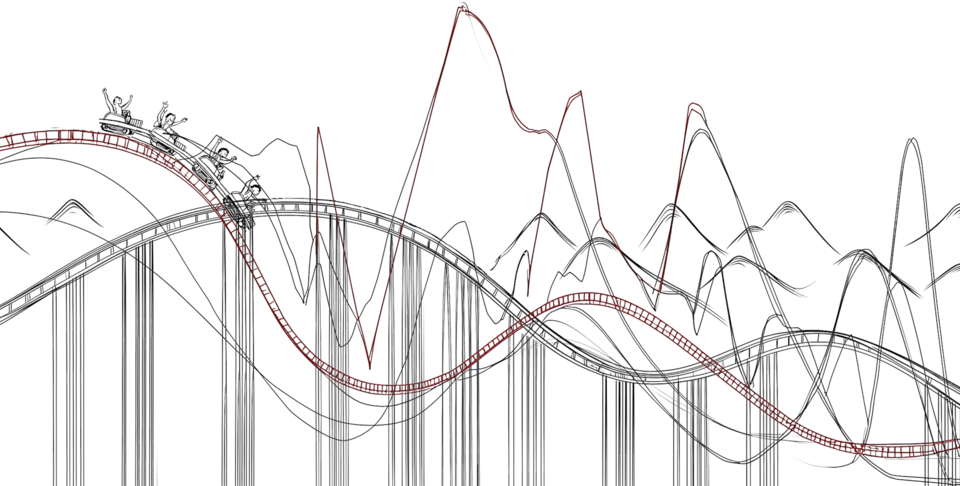

Over the next hour I received some education about how making small but steady investments over the next 40 years would yield a considerable amount of growth as market values increased over time. There are ups and downs, of course. A chart of publicly traded markets over the last century will show the recessions in the ’30s, ’80s and the other big one in 2008. But if you’re patient and stay the course over multiple decades, you eventually get a payoff on your hard-earned investment.

Starting a long-term savings plan is a bit like the first few years of paying off a mortgage. You don’t feel like you’re getting anywhere, and the numbers on paper don’t seem particularly exciting. But that’s the point. You can enter the market with your hard-earned money with a moderate to small amount of risk, then check in on it maybe once a year. Steady, mostly safe and mostly boring.

If you start to move your money into more exciting investments, the risk ratchets up exponentially. This is where professional day traders, non-professional retail investors and crypto bros seek their fortunes. And—perhaps unsurprisingly—there are many folks doing just that in the Sea to Sky as they attempt to subsidize their mountain lifestyles.

I’ll note that I’m not here to tell anyone what to do with their money or how much risk to take when investing it. That’s a personal choice, and everyone has a different risk tolerance. I’m also not qualified to be giving financial advice, so make sure to seek out professional guidance on how to best manage your own money. What I will outline are a couple of things I learned from a stint of working in the finance industry that changed my outlook on personal wealth.

Let’s start with the big one—active investment. According to Investopedia, “Active money management aims to beat the stock market’s average returns and take full advantage of short-term price fluctuations.” This is the r/wallstreetbets (the famous Reddit group behind the GameStop short squeeze) kind of investing that requires a deeper analysis, a degree of expertise and hopefully, a bit of experience to help navigate the unknown. Active investment is a risky place, and too many people believe themselves to have insight on the stocks they bought through a retail investor app like Robinhood (or the Canadian alternatives like Qtrade, Wealthsimple Trade and Questrade). The problem is, any information readily available to the public is already baked into the stock price—a theory known as the efficient-market hypothesis. Without getting too deep into the weeds, modern communication speeds in global markets mean that, for example, if you read an article about a particular stock at 8 a.m. and try to buy stocks by 8:05 a.m., you’ve already missed the market gain. If you’re privy to information before it has been made public and make the buy, you’re committing the crime of insider trading. Some disagree with the efficient-market hypothesis and point to the well-timed investments by luminaries like Warren Buffett as proof. But Warren Buffett is a lot smarter than the bros in your group chat.

The other is around diversification. Owning eight different stocks in your retail investment app is not having a diversified portfolio. There are many different ways to diversify your investments that your financial adviser can point you to, but I’ve found that an index fund (a collection of a few dozen stocks in certain industries) is the best balance of moderate risk and moderate reward in the market.

These methods of growing your money are boring, I know. But if you want to gamble, play online poker with your pocket money or put money on sporting matches. Don’t bet you or your family’s financial future on a stock market play.

I heard a horror story recently that reinforced my desire to keep my finances boring. A friend of a friend had made a series of massive cryptocurrency gains, doubling his money several times with well-timed buys and sells. But after clicking on a link in some cryptocurrency group chat, he was hit with a two-factor authentication scam. The hackers gained remote access to his desktop computer, where his crypto wallet was wide open. Leaving his desk for less than an hour, hackers drained all of his cryptocurrency—about half a million USD. I can’t imagine that kind of loss, but it comes with the territory of making your finances a source of daily excitement.

Best to keep the adrenaline for the mountain sports.

Vince Shuley is a patient and boring investor.