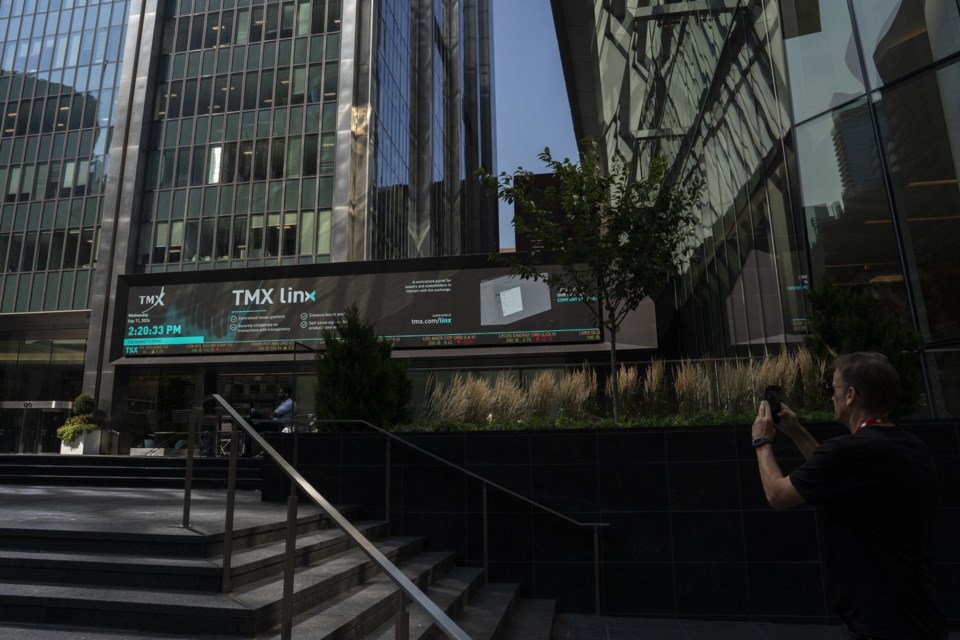

Canada's main stock index saw modest gains Tuesday and U.S. markets were mixed as the latest U.S. tariff deadline approaches with relatively little fanfare.

The S&P/TSX composite index was up 47.43 points at 27,364.43.

In New York, the Dow Jones industrial average was up 179.37 points at 44,502.44. The S&P 500 index rose 4.02 points at 6,309.62, while the Nasdaq composite was down 81.49 points at 20,892.69.

Stock market activity has been relatively muted in the lead-up to Aug. 1, when a pause on a slew of U.S. tariffs is set to expire.

Michael Currie, senior investment adviser at TD Wealth, said there seems to be much less preoccupation with the import levies now than back in March and April, when the worries were constant.

"Anecdotally, I'm shocked how little it's coming up in conversations," he said. "It's not really a hot topic right now on most traders' minds and most investors' minds."

Companies are now better able to quantify the impact of tariffs and let shareholders know what they can do to mitigate it.

"It's less of a mystery now. Even though it's not 100 per cent certain, it's being factored in," said Currie. "There's an assumption that it's not going away and the companies are dealing with it, whereas before it was a great black box out there."

Talks are underway on possible trade deals with other countries that could lower the proposed tariffs before they kick in. U.S. President Donald Trump announced an agreement with the Philippines on Tuesday.

After the bell on Tuesday, CN Rail lowered its earnings forecast for this year and removed its previously issued 2024-26 outlook all-together given "the continued high level of macroeconomic uncertainty and volatility related to evolving trade and tariff policies."

There were also few notable earnings in the U.S.

General Motors beat analyst expectations for quarterly profits, but its stock dropped 8.2 per cent as it said the pain from tariffs is expected to persist. The automaker said it’s still expecting a US$4 billion to US$5 billion hit to its results this year because of tariffs and that it hopes to mitigate 30 per cent of that.

Defence contractor Lockheed Martin Corp. saw a nearly 11 per cent drop in its stock after it reported US$1.6 billion in one-time charges during its second quarter linked to its aeronautics and helicopter businesses.

Meanwhile, homebuilders D.R. Horton rallied 17 per cent and PulteGroup jumped 11.5 per cent as they reported better-than-expected results.

With markets at or near record highs, a lot of investors are staying on the sidelines for now, Currie said.

"We're probably coming into what's traditionally a slow period, maybe not the best time to be jumping in," he said.

"We're starting to get those views from people — not selling, but just not really adding new cash here. We'll be looking for a better entry point."

The Canadian dollar traded at 73.34 cents US compared with 73.03 cents US on Monday.

The September crude oil contract was down 64 cents US at US$65.31 per barrel.

The August gold contract was up US$37.30 at US$3,443.70 an ounce.

This report by The Canadian Press was first published July 22, 2025.

Companies in this story: (TSX: GSPTSE, TSX: CADUSD)

Lauren Krugel, The Canadian Press