A provincially mandated housing needs report was presented to local officials this week, and while some of the broader insights into Whistler’s years-long housing crisis are by no means new, it does offer what is probably the most comprehensive view yet into the resort’s housing landscape.

In 2019, the B.C. NDP set a deadline for April 2022 (and every five years thereafter) for all municipalities and regional districts to complete a report identifying their community’s current and anticipated housing needs.

The robust, 69-page report compiles troves of data, including statistics from the 2016 census, Whistler’s Community Life Survey, the Canadian Mortgage and Housing Corporation (CMHC), BC Housing and the 2021 Resort Municipality of Whistler (RMOW) Housing Survey. The analysis will be updated with 2021 census data once it’s available, expected this summer.

The key takeaways? Whistler needs more purpose-built rentals, and smaller dwelling units for both ownership and rental, along with a range of supportive housing for the community’s most vulnerable.

“There’s certainly a need for affordable units, pointing to purpose-built rentals to fill that affordability gap, equitable housing opportunities for families and for other types of households that are currently on a lower-income spectrum and may have higher costs, downsizing opportunities for seniors—so a need for smaller units and more density, and a need for really a deeper view of accessible housing and secure housing options to really proactively address the needs of Whistler’s vulnerable populations,” explained Becca Zalmanowitz, RMOW strategy analyst, in a media briefing on May 9.

The analysis points to the need to optimize existing resident-occupied properties, with many of Whistler’s larger market homes—considered houses with three or more bedrooms—owned and occupied by just one or two people. This further speaks to the need for smaller bachelor and one-bedroom units “to enable aging in place and encourage movement through the housing continuum” for both ownership and rental.

Employee-restricted Whistler Housing Authority (WHA) units are of course not immune to this trend either, primarily due to different family makeups.

“When I look at the numbers of employees versus beds, there’s not an employee in every single one of those beds,” said Councillor Cathy Jewett.

According to WHA data, roughly 60 per cent of ownership bed units are occupied by an actual workforce member, while the rate for rentals is higher, at around 75 per cent. “So keeping in mind, if we want to house the workforce, we’d have to build more bed units than the actual permanent workforce we’re looking to house,” Zalmanowitz added.

The report also concluded that the market alone cannot be leaned on to provide the necessary affordable, secure and appropriate housing units for Whistler’s workforce, with prices having reached a point that the average market property is unaffordable for more than 90 per cent of the community’s residents.

Like many communities, COVID-19 further exposed the risk factors at play for Whistler’s most vulnerable. Earlier this year, the RMOW received a grant from Vancouver Coastal Health to allocate towards a project addressing social determinants of health and community resiliency, and a comprehensive assessment of housing needs for vulnerable populations has been identified as “a very high priority,” the report said. This additional housing assessment will identify the existing supply and need for below-market rentals, social housing, transitional and supportive housing, short-term shelter, and other underserved housing target groups. The report noted a “significant increase” in Whistler’s vulnerable during the pandemic, which often rely on the private market for rental housing, a supply that was further reduced during COVID thanks to resales of market homes.

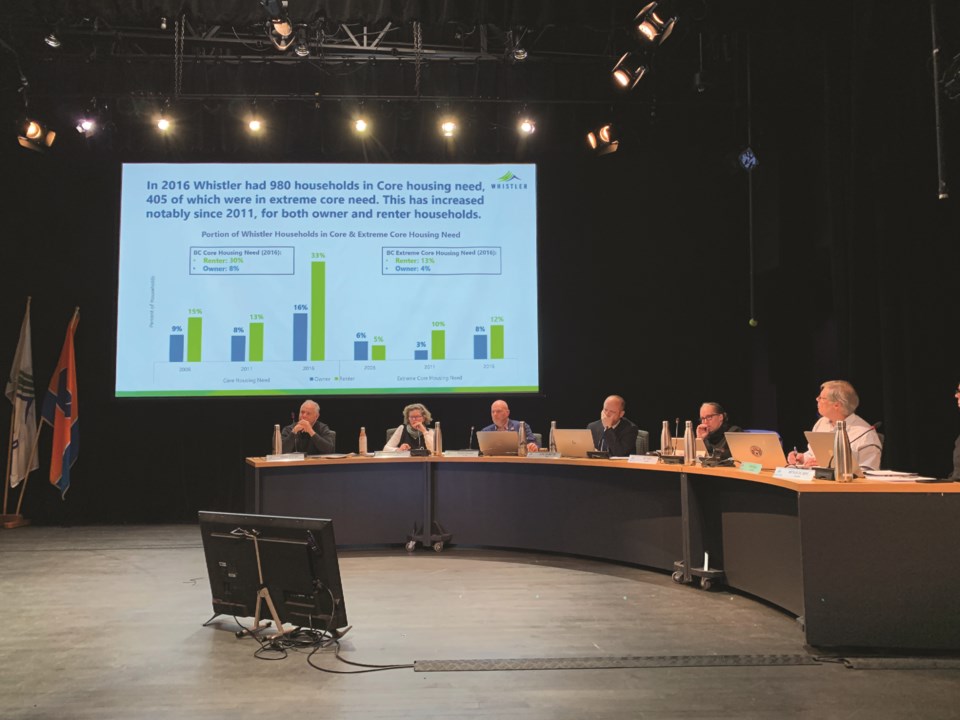

Some of the stats included in the report are sobering, to say the least (see sidebar). The CMHC uses a two-stage metric to identify households in core housing need (those in unacceptable housing paying more than 30 per cent of their gross income to find something acceptable) and extreme housing need (those paying more than 50 per cent of their gross income for the same), and the report found the number of Whistler households in core or extreme housing need doubled from 200 in 2011 to 405 in 2016.

This is far from the first accounting of Whistler’s housing needs. In 2016, the Mayor’s Task Force on Resident Housing undertook similar work, which resulted in a number of recommendations to address shortages. That’s in addition to the regular analysis done by the WHA. The RMOW’s Balance Model Initiative, which is currently in development, is aimed at understanding shifting trends in Whistler’s population, and will study the capacity of services and amenities—housing included—as the resort continues to grow.

“When you hear about so many people leaving town because of this or that, or how many employees we need just to turn the lights on everyday and pour the coffee and run the lifts, I think this is one piece for us to understand what we need to build,” said Coun. Jen Ford at Tuesday’s meeting. “We need to house the employees in this town so they have a sense of belonging. I think that’s what this is: This is creating a sense of belonging in this community and not just for a certain person, but for everyone to feel welcome here, whether they’ve been here for six months or six decades.”

Find more information at whistler.ca/HousingNeedsReport.

This story has been updated to better clarify CMHC's core and extreme housing need metric.

Housing by the numbers

1,340: Number of 2016 census households (nearly 30% of all Whistler census households) that spent more than 30% of their gross income on shelter costs

85%: Estimated percentage of employees in 2019 that lived locally

2,100+: Number of employee-restricted rental and ownership dwellings in Whistler

10%: Percentage of market residential properties rented long-term to residents in 2021

75%+: Percentage of secondary suites rented to Whistler residents in 2021

$61,000: Median household income of a local renter household

83%: Percentage of lone-parent families with children renting in Whistler that cannot afford a suitably-sized WHA property

80%: Percentage of couple renter households with children that cannot afford a suitably sized WHA property

84%: Percentage of single-person renter households that cannot afford a suitably sized WHA property