Whistler has a multi-million-dollar decision to make this fall — should it add another one-per-cent tax charge to hotel rooms in the resort?

It's a question long considered in Whistler but now, the provincial government has paved the way forward for cites and towns in B.C. to charge more tax on hotel rooms, moving from a two-per-cent tax to three per cent.

In 2014/15 the province distributed $30.6 million throughout B.C. through the Municipal Regional District Tax (MRDT) program. If everyone increased the tax by one per cent, it could bring in roughly $15 million more for tourism-related projects.

As the City of Vancouver moves forward with the hotel tax increase on Sept. 1, separate of the rest of the province, Whistler is still weighing the pros and cons of the change, which comes with an 11th-hour provincial caveat: if it bumps up the hotel tax to three per cent, it must also sponsor a new provincial tourism program called the Tourism Events Program that would focus on bringing events like the FIFA World Cup or Canada Winter Games to B.C.

That, among other things, needs some consideration, said Mayor Nancy Wilhelm-Morden.

"I don't know that we necessarily want to be increasing the cost of accommodation in Whistler by way of this new tax in order to fund provincially initiated tourist events," said Wilhelm-Morden.

"Does that make sense for Whistler? We don't know the answer to that question yet."

That's a fair question according to local MLA Jordan Sturdy.

"If we're going to add an extra per cent and yet it's going into some pool somewhere, does that really provide enough benefit to us?" he asked. "I think that's a completely legitimate question. I'd ask it... I am asking it!"

The finer details of the program, as yet, are not public. They will be released when the program opens for applications next month.

Tourism Whistler President and CEO Barrett Fisher said there would be no decision until stakeholders understand the nuances of the program.

"At this point, we have not seen the information package and corresponding criteria," she said.

According to the province, the program is designed to entice "significant events and celebrations that offer a high tourism value."

In response to questions from Pique, the ministry of tourism emailed: "Sponsorship amounts for the Tourism Events Program will vary by community depending on the amount of MRDT funding the community collects.

"The new program will complement local MRDT programs and projects to increase tourism revenues and visitation to British Columbia."

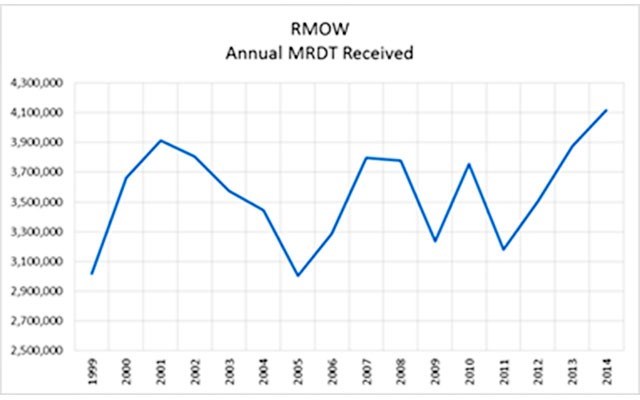

Last year, Whistler collected $3.9 million in MRDT — the most it has ever collected, as the resort broke records for room nights last year. It has budgeted more than $4.1 million in 2015 in MRDT revenues at the current two-per-cent tax. The tax funds program such as Whistler's sister city program, the free village shuttle and almost $2 million goes toward Tourism Whistler. Monies are also funnelled into projects — $130,000 for large group and conference business growth and $476,000 went towards upgrades at Meadow Park Sports Centre, among other things.

Another one per cent in hotel tax means roughly another $2 million for Whistler.

For the hotel guest, it means the cost of staying in Whistler will go up... marginally.

For example: a room with a base rate of $200 in Whistler would be charged eight per cent PST ($16) plus two-per-cent MRDT ($4). The total bill would be $220. A one-per-cent increase to the MRDT would be $2 on that room, for a total bill of $222.

"Nobody likes taxes," admitted Norm Mastalir, head of Whistler's hotel association. "But I think it's our collective opinion that it isn't really going to make a terrible disadvantage.

"Any time you add these things it's part of the cost of coming to your destination, so you always have to be careful about it, but I believe that we feel the benefits outweigh the negatives."

The other thing to consider, he added, is the large pool of money this added tax creates to keep Whistler competitive and current.

To the individual consumer, the tax increase is almost negligible, said Mastalir. But to the collective pot, the $2-million increase is significant.

"And more importantly, we're faced with ever-increasing budgets at some of our competitor destinations for marketing... We're getting outgunned in a lot of ways, some people might say," said Mastalir. "And so, I think we're just trying to make sure that we can properly continue to fund all the positive things that we do here in Whistler to make this such a great destination. And I think you have to be realistic as you move forward about how you are going to do that."

The overall MRDT program will be enhanced, too, with stronger accountability and reporting requirements.

This is to help ensure greater transparency in how the tax dollars are used in communities and what they achieve and how they align with the local, regional and provincial tourism goals.